Enact, the SME fund managed by Leeds-headquartered private equity house Endless, has invested in Pal International.

Enact are delighted to announce the acquisition of Pal International from its family owners. Pal was established in 1970 and has over forty years experience in providing hygiene solutions and infection control in healthcare, food manufacturing and industrial markets.

Pal’s head office, medical grade manufacturing site and European warehouse are based in Lutterworth, Leicestershire. The business also has an office & warehouse in Dubai helping to support an extensive distribution network that covers more than 70 countries.

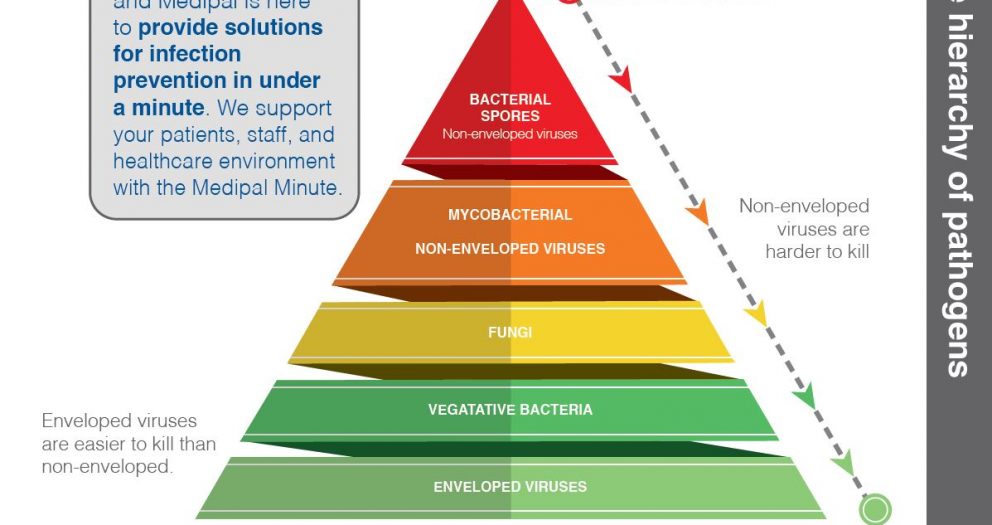

Pal continues to be a market leader in the development and manufacture of infection prevention and contamination control products, that carry the Pal brand supplying into heavily regulated end markets that require medical grade accreditations and approvals to conform with strict health and safety standards while also offering bespoke products to key customers to create products specific to them and their regulatory and hygiene needs.

Chris Cormack, Partner of Enact commented “We are delighted to acquire Pal and provide the investment needed to recapitalise the business. The Pal brand is recognised and trusted worldwide and has an excellent reputation in the highly regulated markets in which it operates. We are looking forward to supporting the management team to take advantage of a number of identified market opportunities which will enable further growth and development of the Pal brand”.

Enact invests transformational capital of up to £5 million into UK based SMEs. The individuals who comprise the investor base of Enact Fund II include successful entrepreneurs, existing and former Board members of successful Yorkshire businesses and management from former portfolio companies. The single biggest investor in the Fund is the Endless and Enact partner and employee group.

Enact was advised by Simon Pilling, James Cook and David Ridley of Womble Bond Dickinson and Russ Cahill of the Tax Advisory Partnership. Pal were advised by Interpath and Freeths.